News

COMING HOME RETREAT FOR VETERANS – MAY 19

(Barrington, IL) The “Coming Home” Veterans Retreat offers a reflection on the transitions to and from military life. On May 19th from 8:00 a.m. to 5:30 p.m. at Bellarmine Jesuit Retreats, 420 W. County Line Road, Barrington, veterans and their family members will spend the day with others who understand and may share their experiences. This retreat is offered at no charge for all interested individuals, regardless of their current faith practices.

Bellarmine retreat leaders understand that no two veterans and no two military families are the same. Some have seen active combat, others haven’t. Some have experienced tremendous losses. Some come back healthy and strong. Some transition back to civilian life rather easily, while others face a variety of challenges. Yet serving in the military or having a loved one wear the uniform creates a common bond.

St. Ignatius of Loyola’s spirituality is the foundation of this retreat experience. Ignatius was born into a military family in 16th century Spain. His brothers were sea captains to the Americas. Ignatius was a respected commander in the Spanish army until a cannonball broke both of his legs. While recovering, he experienced a profound spiritual conversion. He no longer sought to serve an earthly king, but the Eternal King. He no longer sought victory over earthly enemies, but to conquer the spiritual battles that raged within him.

Ignatius became an expert at helping people find meaning and direction in their lives. He believed that God is hidden in the stories of our lives. Veterans and their families are invited to gather with other men and women to share experiences, to tell whatever part of your story you’re comfortable naming. Come look for God in the place you might least expect…in the pages of your life story.

In addition to personal interactions, Major General James H. Mukoyama Jr., a nationally recognized expert, will speak on Unmasking the Truth about PTSD versus Moral Injury. Fr. Ed Max McKenzie of St. Peter’s Coop Chicago and Fr. J. Michael Sparough of Bellarmine will guide conversation and engagement. Teresa Larson of Bellarmine is a veteran spouse and will reflect on family life.

Bellarmine has two libraries, a resource center, two chapels, dining room and many places to relax. Located on 80 acres populated with woodlands and prairie grasses, outdoor

spaces include walking trails, prayer gardens, a gazebo, stations of the cross as well as many patios, chairs and benches. The Retreat is designed to give the peace and serenity needed to be still and rest in God’s loving embrace.

Endorsed by the leadership of the William Chandler Peterson American Legion Post 171 in Crystal Lake, Bellarmine retreats have been experienced by several Legion members. A recent retreatant said, "It has been over 50 years since I left Vietnam. I wish this program was available when I returned home." Legion Sr. Vice Commander Bob Dorn personally attended the retreat and said, “Connect with others and learn how to better understand yourself during this inspirational day.”

To join the retreat on May 19, visit the website and make reservations or call: Bellarmine Jesuit Retreats https://jesuitretreat.org/pages/veterans-coming-home-retreats

847-381-1261

History of Veterans Day

Veterans Day, formerly known as Armistice Day, was originally set as a U.S. legal holiday to honor the end of World War I, which officially took place on Nov. 11, 1918. In legislation that was passed in 1938, Nov. 11 was "dedicated to the cause of world peace and to be hereafter celebrated and known as 'Armistice Day.'" As such, this new legal holiday honored World War I veterans.

In 1954, after having been through both World War II and the Korean War, the 83rd U.S. Congress -- at the urging of veterans service organizations -- amended the Act of 1938 by striking out the word "Armistice" and inserting the word "Veterans." With the approval of this legislation on June 1, 1954, Nov. 11 became a day to honor American veterans of all wars.

If the Nov. 11 holiday falls on a non-workday -- Saturday or Sunday -- the holiday is observed by the federal government on Monday (if the holiday falls on Sunday) or Friday (if the holiday falls on Saturday). Federal government closings are established by the U.S. Office of Personnel Management. State and local government closings are determined locally, and non-government businesses can close or remain open as they see fit, regardless of federal, state or local government operation determinations.

United States Senate Resolution 143, which was passed on Aug. 4, 2001, designated the week of Nov. 11 through Nov. 17, 2001, as "National Veterans Awareness Week." The resolution calls for educational efforts directed at elementary and secondary school students concerning the contributions and sacrifices of veterans.

Things You Don't Know About Veterans Day

It's "Veterans Day," not "Veteran's Day," for a good reason. The lack of the apostrophe might seem like a semantic choice, but it has a definite and deliberate meaning. According to the U.S. Department of Veteran Affairs, Veterans Day is not a day that belongs to veterans, it is a day for honoring veterans directly in front of us right now.

Veterans Day used to be celebrated on the fourth Monday of October. In 1968, Congress passed the Uniform Monday Holiday Act, which stated that Washington's Birthday, Memorial Day, Columbus Day, and Veterans Day would all be celebrated on Mondays. The reason for doing so was to create three-day weekends, which hopefully encouraged travel and other recreational activities that would help stimulate the economy. However, many states did not agree with the change, particularly for Veterans Day, which holds significant historic and patriotic significance. And so on Sept. 20 1975, President Gerald Ford signed Public Law 9497, which returned the observance of Veterans Day to Nov. 11, beginning in 1978.

Armistice Day became Veterans Day in 1954. Although today we all know it as Veterans Day. Nov. 11 was originally called "Armistice Day" in recognition of the armistice agreement that ended WWI on Nov. 11, 1918. While WWI was called "the war to end all wars," it failed to do just that. By the early 1950s, millions of Americans had served in WWII in the Korean War. So, in an attempt to be more inclusive and honor this younger generation of veterans service, Armistice Day was changed to Veterans Day on June 1, 1954.

Over the past several decades, there have been nearly 700 military bases with both confirmed and suspected PFAS exposures. Located across the United States and all branches of the military, these exposures have been known to cause reproductive and immune system problems, thyroid disease, and cancers—among other health problems. These are a few of the notable base exposures.

Aberdeen Proving Ground- Edgewood, Maryland. The U.S. Army’s largest proving ground since 1917, this military site is used to develop and test military protection, communication, and intelligence technology.

On this proving ground and on many other military sites, the use of fluorosurfactant-containing firefighting foams during training exercises has been identified as the main source of contamination.

Consequently, due to the use and disposal of chemicals on site, the groundwater and surrounding soils were contaminated with highly toxic fluorinated compounds (PFAS) and other toxins. These chemicals made their way into the groundwater, exposing the base and the surrounding communities.

Camp Lejeune- Jacksonville, North Carolina. After opening in the fall of 1941, this 244-square mile Marine Corps base was used for marine and sailor training exercises. In the decades between 1953-1987, the Environmental Protection Agency (EPA) has estimated that over one million military personnel were exposed to toxic chemicals due to contaminated water wells at Camp Lejune. The service men and women, along with any family members accompanying them on base are at risk for developing health complications due to this exposure.

Upon testing, several volatile organic compounds (VOCs) were found in three drinking water systems on the base—Tarawa Terrace, Hadnot Point, and Holcomb Boulevard.

Chemicals include vinyl chloride, benzene, and perchloroethylene (PCE). Water safety testing conducted in 1980 uncovered these chemicals, however, there was no public statement made until 1997.

Fort Ord- Monterey, California. Operational from 1917-1994, this former U.S. Army Post was mainly a basic training and staging facility. Acquired during the first World War, this post was used to train troops deploying to fight in WWI, WWII, and the Korean and Vietnam Wars. An estimated 1.5 million troops were trained at the base during this time.

In 1990, the EPA deemed Ford Ord a Superfund site, recognizing it as one of the most polluted areas in the nation. Even in 2017, over two decades after its closing, the groundwater contamination levels were still well over 300 parts per trillion (ppt), significantly surpassing the EPA’s acceptable limit of 70 ppt.

While Fort Ord is no longer used as an active military base, a majority of the land makes up the Fort Ord National Monument, which is open to the public. The monument is comprised of over 86 miles of trails for hikers, bikers, and equestrians.

McClellan Air Force Base- Sacramento, California. This Air Force base was active between the years 1935-2001 and was primarily used as a maintenance and logistics center for military aircrafts and vehicles.

According to the EPA, “The operation and maintenance of aircraft have involved the use, storage and disposal of hazardous materials, including industrial solvents, caustic cleansers, paints, metal plating wastes, low-level radioactive wastes and a variety of fuel oils and lubricants.”

Also deemed a Superfund site by the EPA in 1987, this 3,452-acre base had approximately 326 areas of known and suspected contamination. While the base has been closed for over 20 years, the cleanup of toxic chemicals and PFAS is ongoing.

With millions of veterans exposed to these toxins during their service, they carry a higher risk of developing health complications. New toxin bills, including President Biden’s PACT Act, aim to expand VA and other healthcare benefits to the veterans who were exposed to toxic materials during their time serving.

Learn more about other PFAS detections and military base contaminants on a more extensive map here.

VA will begin implementing the VSignals survey for the Specially Adapted Housing (SAH) program, administered by VA Loan Guaranty Service (LGY).

The SAH program administers housing adaptation grants to seriously disabled service members and Veterans with certain, very severe service-connected disabilities. SAH grants assist eligible service members and Veterans with building, remodeling or purchasing an adapted home that is suited to the individual Veteran’s specific, unique physical needs. These adaptations, funded by SAH grants, help these American heroes live more independent lives.

VSignals will help the SAH program identify important moments during SAH grant eligibility and funds disbursement administration where VA staff can learn important lessons through feedback from service member and Veteran customers. These lessons will help identify and create essential changes to the grant process which will improve customer experiences. The VSignals SAH survey will also arrange and make permanent a systematic method of responding to and resolving any customer service issues that a Veteran recipient of an SAH grant may encounter.

VSignals key facts

The VSignals survey allows VA to collect, analyze and track customer experience feedback from service members, Veterans and other stakeholders, and use it to identify opportunities to enhance the SAH customer experience.

The SAH VSignals survey implementation reinforces VA’s commitment to provide proactive, personalized, benefit-centric resources to seriously disabled service members and Veterans.

“Enhancing the customer service experience for Specially Adapted Housing (SAH) grant recipients means being attentive to the experiences of our most seriously disabled Veterans,” said John Bell III, executive director of VA’s Loan Guaranty Service. “The feedback we receive from these selfless American heroes will be incorporated into strategies and planning to improve the grant process, make it more efficient for the Veteran, and inform SAH staff on how best to engage at important moments in the grant process itself.”

VA’s Veteran Experience Office (VEO) developed VSignals to collect, analyze and track customer experience feedback from Veterans and other stakeholders on important programs administered by VA. VSignals helps identify opportunities to enhance VA’s customer experience and improve overall VA performance. VA is deploying a collection of three VSignals surveys on the SAH program.

These SAH VSignals surveys will measure Veterans’ customer experience at three critical milestones (known as “Moments that Matter”) in their SAH grant usage journey:

Survey 1: Initial Interview

Survey 2: Grant Approval

Survey 3: Final Grant Fund Disbursement

Each of these SAH VSignals surveys contains a set of Likert (1 to 5 scale) questions; each question is aligned to one of the seven Office of Management and Budget (OMB) A-11 customer experience domains. Survey data is collected on a weekly basis and reported on a monthly, quarterly and annual basis.

Once participants complete the above milestones during the SAH grant life cycle they will receive an invitation to complete the survey via email. The message contains a weblink, enabling the Veteran to complete the survey using an online interface. Participation is optional, and Veterans may decline to participate and opt out of future invitations. To prevent survey fatigue, VSignals maintains a quarantine protocol across all VA VSignals surveys to limit the number of times a Veteran may be contacted.

VSignals surveys and feedback will benefit future SAH grant recipients by helping VA adjust its grant use processes to streamline the experience for Veteran grant recipients, and VA is eager to receive and incorporate invaluable feedback from Veterans adapting their homes to enhance their abilities to live more independent lives after sacrificing enormously for our country.

More information on the SAH program can be found online at VA’s website: https://www.va.gov/housing-assistance/disability-housing-grants/.

Service members and Veterans with additional questions about the SAH program are encouraged to contact their Regional Loan Center (RLC) at 1-877-827-3702.

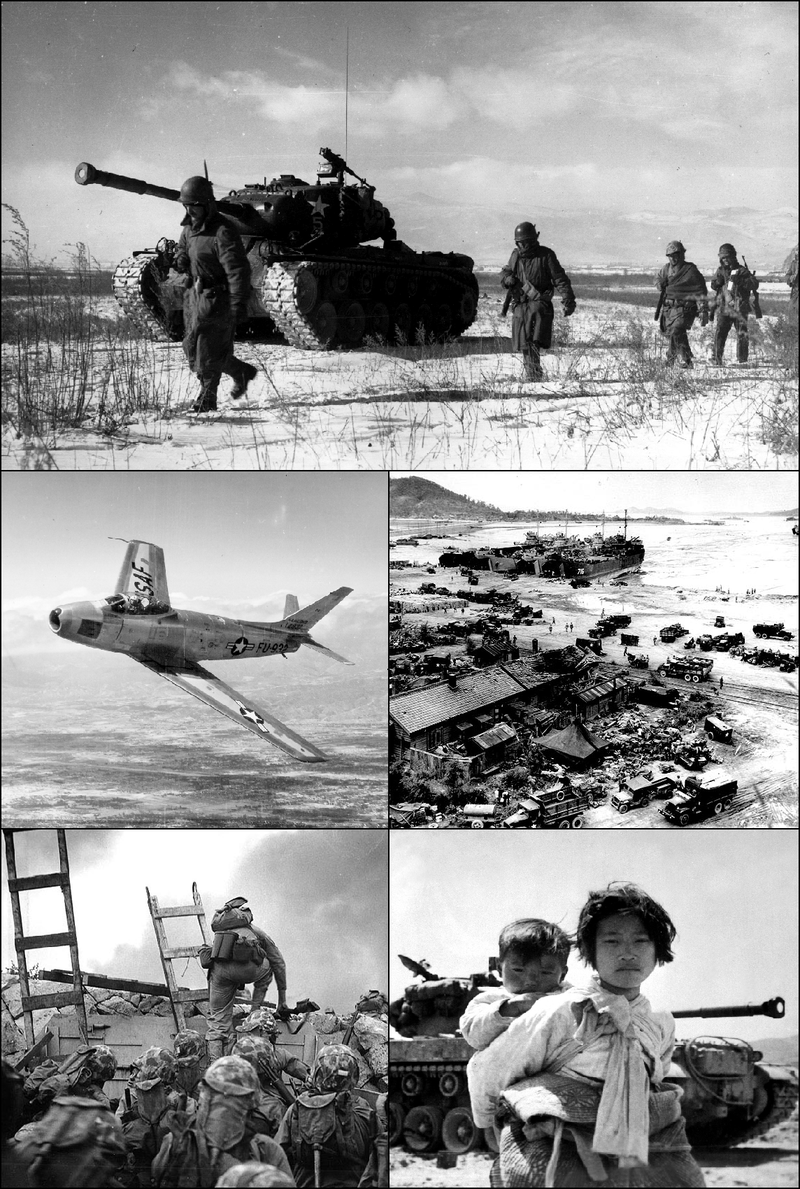

WASHINGTON — On the 69th anniversary of the Korean Armistice Agreement, the Veterans of Foreign Wars (VFW) pays tribute to those who served, fought and died on the Korean peninsula.

On July 27, 1953, U.S., North Korean and Chinese military commanders, signed the Korean Armistice Agreement, bringing the Korean War to a close. A total of 36,576 Americans lost their lives and more than 92,000 were wounded in action during the course of the bloody three-year war on the Korean peninsula. The cease fire came after two years of negotiations, the longest negotiated armistice in history, but did not end the hostilities completely. The majority of the almost 750 deaths of American service members since July 27, 1953, was the result of post-war North Korean hostile actions.

The conflict between North and South Korea is often referred to as “The Forgotten War,” as it was overshadowed in historical size and scope by World War II and the Vietnam War. However, for the service men and women that lived through it, for the Gold Star families that lost their loved ones there, and for those that keep the candle lit for the more than 7,500 POW/MIAs still unaccounted for, the Korean War is still fresh in their minds.

To the millions of U.S. military personnel who served in the Korean War theater of operations, and the millions that have served there since, the members of the VFW and its Auxiliary join a grateful nation in remembering your service and honoring your sacrifice in defense of generations of people living on freedom’s frontier.

Vietnam-era veterans will benefit as Congress nears the finish line on a huge legislation package to expand health coverage for those exposed to toxins during their military service.

The Sgt. 1st Class Heath Robinson Honoring Our PACT Act — which is mainly aimed at expanding care to veterans exposed to toxic burn pits — is also expanding care to veterans who were exposed to Agent Orange outside of Vietnam.

The provisions are a win for veterans advocacy groups, who say that the bill expands a narrow understanding of exposure to the herbicide, which has been linked to a variety of illnesses.

“Agent Orange did not pick and choose … it affected everybody everywhere it was used,” said Patrick Murray, director of national legislative service at Veterans of Foreign Wars.

“We think this is just correcting something that should have been done years ago, and we’re very grateful,” he added.

The House most recently passed the PACT Act on July 13 by a vote of 342-88, about a month after the Senate passed the bill by a bipartisan 84-14 vote.

The upper chamber must pass the measure again, as the House version of the bill includes technical changes from the measure passed last month. The bill then heads to President Biden’s desk, where he is expected to sign it.

Among its provisions, the bill would expand the Department of Veterans Affairs’ (VA) presumptions of service-connected illness related to Agent Orange exposure for those who were exposed in Thailand, Cambodia, Laos, Guam, American Samoa and Johnston Atoll.

Veterans who were deployed in Vietnam were first granted presumed coverage for Agent Orange-related illnesses in 1991 under the Agent Orange Act.

Agent Orange was the most-used herbicide during the Vietnam War, where it was deployed to clear out forests and vegetation that could be used by enemy forces.

The U.S. also used the herbicide along the Ho Chi Minh Trail, which connected northern and southwest Vietnam via military transport routes through Laos and Cambodia. The herbicide was also used in Thailand to clear jungle around military bases.

Murray said that over time, the herbicide became a “quick fix” anytime vegetation needed to be cleared in areas not in Vietnam, leading it to be used in places where it wasn’t necessary, like Guam and American Samoa.

“Places in Vietnam, where maybe you did need that expedited measure done, that’s one thing,” Murray said. “But in American Samoa, there was no enemy that we needed to identify immediately. It was just, ‘This will get a job done.’”

After use of Agent Orange was banned in the early 1970s, remaining batches were taken to Johnston Atoll — a U.S. controlled island 700 miles southeast of Hawaii — where they were later destroyed, according to the Aspen Institute.

The VA presumes that about two dozen types of illness are caused by exposure to Agent Orange, meaning that exposed veterans who have been diagnosed with those conditions don’t have to prove their ailments are related to military service.

The agency’s benefits tied to Agent Orange largely apply to those who served in Vietnam, about 12 miles offshore from the waters of Vietnam, or those who were on regular perimeter duty of either a U.S. military installation or Thai air force base.

Veterans who served in the Korean Demilitarization Zone, were assigned in units that had C-123 aircraft or were involved in testing or storage of Agent Orange also qualify to receive benefits.

Veterans seeking benefits have typically needed to prove that they served, prove something happened to them in service and then prove that what happened is related to military service.

“Most veterans now are really missing two parts,” said Cory Titus, director of veteran benefits and guard/reserve affairs for the Military Officers Association of America, “The only thing they can prove is that ‘I was in service.’ They’re sick, but they can’t connect it back to their time in uniform.”

The Congressional Budget Office estimated last year that about 50,000 veterans and survivors of deceased veterans would receive compensation due to the PACT Act expanding presumptive exposures outside of Vietnam.

The agency also estimated that 51,000 veterans would receive compensation under another provision that would presume hypertension was caused by exposure to Agent Orange. That number would increase to about 464,000 by 2031.

Asked about how many veterans stand to benefit from the Agent Orange provisions of the bill, the VA told The Hill that it would make those estimates once the PACT Act has been passed.

“It will take several weeks to develop these projections after the final PACT Act language is received,” the agency said.

As the legislation nears the finish line, advocacy groups say more will need to be done to address the impact of toxic exposures for veterans.

With the ‘Greatest Generation’ passing away, we must never forget one of their defining moments

December 07, 2021

WASHINGTON — On this day 80 years ago, the sleeping giant was violently awakened. America in 1941 was working on itself. Following the end of the Great Depression in 1939, Americans were just beginning their economic recovery and had returned to their isolationist stance on foreign affairs. Even though they were upset with the carnage ravishing Europe and Asia, they did not have the appetite for another world war. The enormous loss of life from the one-two punch of the Great War and the 1918 pandemic was still fresh in the collective memory of the country. But as the old adage goes, you don’t always have to go looking for a fight, sometimes the fight comes looking for you.

On Sunday morning, December 7, 1941, just before 8 a.m., Japanese forces launched a devastating surprise attack on U.S. naval base at Pearl Harbor near Honolulu, Hawaii. It was a thoroughly planned and executed assault on the U.S. Navy’s Pacific Fleet, sinking or severely damaging 19 ships and destroying or damaging more than 300 aircraft. While sailors, soldiers and Marines stationed there fought valiantly, there was no way to counter the tremendous onslaught. In all, more than 3,500 American men and women were killed or wounded. The 2,403 killed would be the largest single day loss of American life in an attack on the Unites States for the next 60 years.

By the time President Roosevelt had delivered his famous “Infamy” speech less than 24 hours after the first bombs fell on the island of Oahu, the Japanese had already formally declared war on the United States and the British Empire and attacked Malaysia, Hong Kong, Guam, Wake Island, the Philippines and Midway. There were also reports of American ships being attacked along shipping routes between Hawaii and the California coast. Three days later, Nazi Germany declared war on the United States. No longer could the U.S. keep a safe distance from the second world war raging on the other sides of the Atlantic and Pacific. The war kicked in our nation’s front door and it was time for Americans to wake up and fight for freedom.

It is estimated 234 WWII veterans die each day and in 10 years, they will nearly all be gone. The death of retired U.S. Senator and WWII veteran Bob Dole this past weekend is a stark reminder that we don’t have much time left with them. That’s why we must take the time to hear their stories, preserve their legacy and honor their sacrifices.

On this National Pearl Harbor Remembrance Day, the Veterans of Foreign Wars (VFW) encourages everyone to take a moment to remember the 2,403 victims tragically lost in the attack, and remember the defining moment when brave young American men and women rose up to defend our nation, help liberate the world from tyranny and become “The Greatest Generation.”

WASHINGTON — The Department of Veterans Affairs has expanded the Shallow Subsidy initiative and will grant $200 million to 238 nonprofit organizations across the country and territories to provide housing rental assistance to extremely and very low-income Veteran households eligible under VA’s Supportive Services for Veteran Families program.

The initiative funded by The American Rescue Plan, is now available in every state, the District of Columbia, Puerto Rico, U.S. Virgin Islands and Guam and promotes long-term housing stability by providing rental assistance payments directly to landlords on behalf of eligible Veteran households for up to two years.

“VA’s Shallow Subsidy initiative is a vital tool in addressing the widening gap between incomes and rising housing costs,” said VA Secretary Denis McDonough. “The recent expansion enables VA to provide relief to many more Veterans burdened by high housing rental costs while they attempt to increase their incomes by pursuing training or better employment opportunities.”

The SSVF Shallow Subsidy initiative covers 35% of eligible Veterans’ rent for two years without the risk of the subsidy decreasing if the Veteran’s income increases during the two-year period. The purpose is to incentivize Veterans to increase their income through employment or other means. The initiative also works closely with the Labor Department’s Homeless Veterans' Reintegration Program to help Veterans secure employment.

There are 7.2 million more affordable housing units needed for low-income families according to data published by the National Low Income Housing Coalition, highlighting the need for this VA initiative, particularly in communities with high rental costs and low housing rental vacancy rates.

The Shallow Subsidy initiative aligns with the White House’s priority to promote housing stability by supporting vulnerable tenants and preventing foreclosures.

Learn more about VA’s mission to end Veteran homelessness and how you can help.

(VAntage Point)

This is about moral injury… and suicide.

Starting at a young age, we learn about right and wrong. Our life experiences, education, and environment help us to develop a moral code, or a set of deeply held beliefs and expectations.

When we experience potentially morally injurious events, our moral code is violated either by our own or other peoples’ actions or inactions. These experiences tend to result in painful emotions (shame, guilt, contempt, anger, disgust) and cognitions (“I am a monster”).

When individuals engage in efforts to try to avoid or control these painful emotions and cognitions, social, psychological and spiritual suffering can result. We describe that as moral injury.

Veterans’ moral injury from combat experiences

Service members and Veterans can experience moral injury as a result of their experiences in combat.

Experiencing a potentially morally injurious event may result in severe distress or functional impairment. Recent research suggests exposure to potentially morally injurious events is a risk factor for suicidal ideation and behavior among Veterans and military personnel.

Some common experiences associated with moral injury include:

Isolation in relationships

Getting caught up in stories about oneself or others related to these morally injurious events

Engaging in behaviors to try to get rid of painful and moral emotions (such as drinking)

Disconnecting from spirituality

Not keeping up with self-care

Understanding the injury

VA researcher Lauren Borges is a suicide prevention expert. She strives to understand more about the link between suicide prevention and moral injury.

She often uses chain analysis, a technique designed to help understand the function of a particular behavior. It explains that successfully identifying and treating moral injury can help prevent suicide among Veterans.

However, treating this type of injury comes with a unique set of obstacles and challenges. An influx of recent research helps providers identify moral injury. Still, patients are often reluctant to share their true feelings due to concerns around feeling judged or even ashamed.

“In a qualitative study we found that moral injury was often not discussed in treatment. A key component of our approach to therapeutic risk management of suicidal behavior involves the application of chain analysis to understand the function of suicidal behavior.

“If suicidal behavior is functioning to avoid or control painful moral emotions, such as shame, guilt, contempt, anger and disgust, we will often assess exposure to potentially morally injurious events to determine if this is influencing the Veteran’s suicidal behavior.”

VA supports providers treating Veterans at risk

Borges is a consultant and lecturer for the Suicide Risk Management Consultation Program (SRM). This month, she will present how clinicians and health care teams can conceptualize and effectively target suicidal behavior in the context of moral injury.

These free, live webinars are offered on the second Wednesday of every month from 2 to 3 p.m. ET. Interested providers can register here, and a recording will also be available for those who are unable to attend the live event.

SRM offers free consultation, support and resources that promote therapeutic best practices for providers working with Veterans at risk.

SRM providers can help VA and community providers identify and treat moral injury among their Veteran patients. Providers can learn more and request a free consult here.

WASHINGTON — The Department of Veterans Affairs and the PenFed Foundation brought together 80 women Veteran entrepreneurs for a six-month accelerator program, July 13 that would prepare them for sustainability and growth in federal and commercial marketplaces.

Participants came from 29 states and are VA Center for Verification and Evaluation verified, have three to five years in business and have past performance as a prime or subcontractor.

“It’s important we provide an environment where women entrepreneurs can receive strategic and deliberate education, empowerment, engagement and access to enhance their businesses,” said VA Office of Small and Disadvantaged Business Utilization Executive Director Sharon Ridley. "Through entrepreneurship, women Veterans have an opportunity to leverage their military and leadership skills to increase and create economic opportuites.”

Classes are focused on relationship building, product/market analysis, business development and growth preparation. Participants meet in small groups and receive coaching from industry leaders such as AstraZeneca and Halfaker & Associates and OptumServe.

The program culminates with a pitch competition in October. The participant with the winning pitch will receive a PenFed Foundation grant to be used to grow their business.

“We have a shared goal: to empower women Veterans and create access to capital and system to support them,” said PenFed Foundation President and retired U.S. Army Gen. John W. Nicholson, Jr. “We believe in creating a business ecosystem that establishes service in the U.S. military as the most reliable pathway to successful entrepreneurship."

Learn more about the Veteran Entrepreneur Investment Program. Learn more about VA’s mission to empower and educate Women Veteran entrepreneurs for success and economic opportunities at the Office of Small and Disadvantaged Business Utilization.